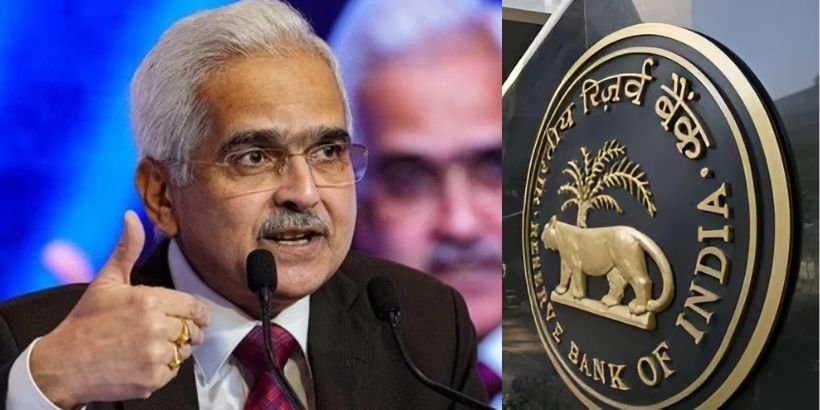

The middle class people were hoping that this time the Reserve Bank of India might change the repo rate. But all their hopes were dashed. With this one decision of RBI, the hopes of cheap loans and reduction in EMI have been dashed again. Let us tell you that this is the 11th time when RBI has not made any cut in the repo rate. Yes, RBI has once again kept the repo rate stable. Actually, according to media reports, while giving information about the decisions of the monetary review meeting, Reserve Bank of India Governor Shaktikanta Das announced to keep the repo rate stable. The governor said that “Once again there has been no change in the repo rate. It has been decided to keep it stable at 6.5 percent. This decision was finally taken after three days of brainstorming by the MPC. After which it has been decided not to cut interest rates.

Let us understand in simple language, what is repo rate?

Banks also sometimes need a large amount for their work, for which they take a loan from RBI for some time. The Reserve Bank charges interest on such sudden loans. Which is called repo rate. In this way, a large amount remains with the banks, which they deposit in the Reserve Bank, on which they get interest from RBI. That is called reverse repo rate. Now here the reduction of the repo rate means that banks will get cheap loans from the RBI at a lower interest rate. When the bank gets a cheap loan, it will also give loans to its customers at cheaper rates. That is, when RBI reduces the repo rate, then the banks reduce the interest rate on car loan, home loan etc. interest rates are cut.

What did the RBI governor say about the repo rate?

RBI Governor Shaktikanta Das said in the press conference that “MPC and RBI’s policy affects people’s lives. Its impact is on the common man’s life as well as the country’s economy.” He said that “Our responsibility is to control inflation. Our responsibility is to strengthen GDP. Inflation has had a bad effect on GDP growth.”

Read Also:- GST officials raid ICICI Bank over tax related matters

Inflation is expected to decrease between January and March

Meanwhile, Governor Shaktikanta Das said that “4 out of 6 members of the monetary committee were not in favor of changing the repo rate. RBI cut the Cash Reserve Ratio i.e. CRR by 0.50 percent. With this cut, the CRR has come down from 4.50 percent to 4 percent. One decision of RBI will increase liquidity of Rs 1.6 lakh crore in the market.” On this he further said that RBI has maintained the SDF rate at 6.25% and MSF rate at 6.75%. Well, in the meantime RBI has predicted a decrease in inflation from January to March.

Latest News Supreme News Network

#RBIAnnouncement #LoanInterest #EMIRates #HousingLoans #FinanceNews #EconomicPolicy #Homebuyers